US Employees: As we approach the end of the year, Do Good by electing to receive your tax documents electronically. Opt in by completing your W-2 Consent and, if you are eligible for Vail Resorts’ health insurance, your 1095-C Consent.

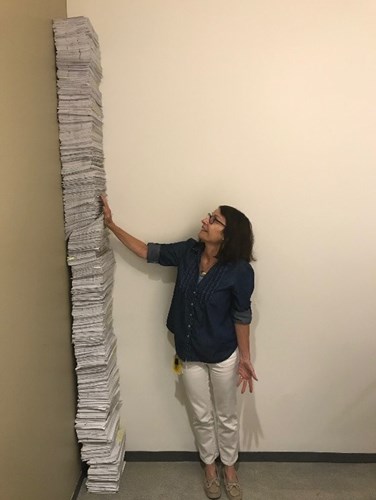

Every year we print and mail thousands of paper tax forms. Many end up being returned to us as undeliverable and have to be shredded – like this stack pictured from 2018! Not only is this a waste of materials like paper and ink, but each form that is mailed requires $1.15 in postage.

By signing up to receive your tax forms electronically, you are alleviating this waste and helping us achieve our Commitment to Zero goal of zero net emissions by 2030. There are also several advantages to receiving your tax documents electronically:

- Earlier Access – Traditionally, a paper W-2 is mailed on Jan. 31 and a paper 1095-C is mailed on March 2 (if applicable), which means you receive them several days later. If you elect to receive your form electronically, you have access before those dates, allowing you to file your taxes faster.

- Greater Accessibility - As long as you have internet access, your tax forms are accessible from anywhere, and will be available for four years following the calendar year applicable for the form.

- Better Security - Each year thieves target mailboxes for Form W-2s so they can steal tax refunds. Receiving your Form W-2 electronically significantly reduces the possibility of your form being stolen.

Ready to opt in? Complete your W-2 Consent and 1095-C Consent to receive your tax forms electronically.

Questions? Head over to Direct Connect: Learn More & Get Help to learn about W-2s and 1095-Cs.